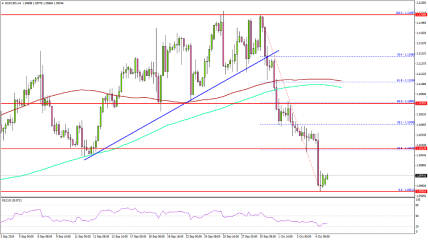

EUR/USD holds ground near 1.1150 ahead of Eurozone PMI data

EUR/USD maintains its position around 1.1160 during the Asian hours on Monday. The US Dollar (USD) may depreciate following the rising likelihood of further interest rate cuts by the Federal Reserve (Fed) in 2024, which may underpin the EUR/USD pair.

The US Federal Reserve cut interest rates by a larger-than-usual 50 basis points to a 4.75-5.00% range last week. Policymakers also predicted an additional 75 basis points (bps) of rate cuts by the end of the year.

However, Federal Reserve Chair Jerome Powell stated in the post-meeting press conference that the Fed is not in a hurry to ease policy and emphasized that half-percentage point rate cuts are not the "new pace."

On Friday, Philadelphia Fed President Patrick Harker stated that the US central bank has effectively steered through a challenging economic landscape in recent years. Harker compared monetary policy to driving a bus, where it's essential to balance speed. He also emphasized that achieving maximum employment is more than just the number of jobs—it also includes the quality of those jobs.

On the EUR front, European Central Bank (ECB) President Christine Lagarde emphasized in her speech on Friday that monetary policy needs to stay adaptable in a constantly evolving world. Although the core objectives of monetary policy, particularly price stability, remain the same, central banks must maintain flexibility to respond to the challenges of a swiftly changing global economy, according to Euronews.

Traders are expected to closely monitor the Purchasing Managers Index (PMI) data from Eurozone and Germany set to be released later in the day. the monthly PMI serves as a leading indicator of business activity, providing insights into economic health and trends.

REGISTRATION LINK 👇🏻

https://one.exnesstrack.net/a/xfbfc8hw70