EUR/USD Weekly Forecast: Focus now shifts to 1.1275

Another solid weekly performance saw EUR/USD clinch its fourth consecutive week of gains, including a new 2024 peak in the 1.1180–1.1185 band. The strong move higher in the pair came in response to the heightened downward bias hitting the US Dollar (USD).

Powell cemented the case for a rate cut next month

It was a positive week for EUR/USD all along, as market participants continued to punish the Greenback on the basis that the Federal Reserve (Fed) might start cutting its interest rates as soon as September

The issue regarding the potential size of the rate cut seems to be leaning towards a quarter-point reduction, as US recession fears have rapidly fizzled out in response to relatively firm data releases as of late.

The ECB is also expected to reduce rates in September

Despite the ongoing radio silence from the European Central Bank (ECB), investors continue to pencil in two more interest rate cuts by the central bank for the remainder of the year, most likely in September and December, which should take the deposit facility rate to 3.25% by year-end.

The logic behind further easing by the ECB can be found in the worsening conditions of economic and business activity in Germany and the whole euro bloc. While a recession on the old continent may be overstated, the probability of a period of slowdown in economic activity appears more suitable.

It can’t be said the same of inflation in the region, which remains stubbornly elevated, particularly regarding services. However, according to the ECB’s latest survey, wage growth in the Eurozone slowed last quarter, strengthening the argument for another interest rate cut in the next few months and easing policymakers' concerns that rising labour costs would keep driving inflation higher.

Furthermore, growth in negotiated wages decelerated to 3.55% in the second quarter, down from 4.74% in the previous three months, largely due to a significant slowdown in Germany, the bloc's largest economy.

All in all, while the Fed-ECB policy divergence appears to dwindle in the next few months, the focus of attention is expected to be on the real economy, where the US has an advantage over its European peer, thus keeping the downside of the Greenback somewhat contained in the long run.

What’s next for the EUR/USD?

Moving forward, Germany is expected to take centre stage next week, with the releases of the IFO’s Business Climate (August 26), final Q2 GDP Growth Rate (August 27), GfK’s Consumer Confidence (August 28), the advanced Inflation Rate for the current month (August 29), Retail Sales, and the labour market report (August 30). In addition, the preliminary Inflation Rate in the broader euro area is also expected on August 30.

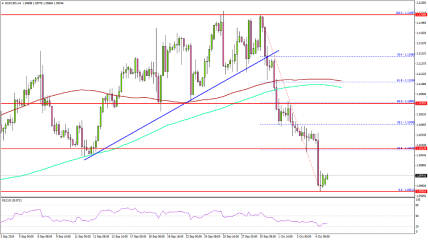

EUR/USD technical outlook

From a technical perspective, EUR/USD is positioned to continue its uptrend. On the weekly chart, spot left behind the key 200-week SMA at 1.1063, which bodes well for the continuation of the ongoing bullish trend for the time being.

On the daily chart, technical indicators remain in the overbought region, while the momentum indicates that the current upside bias remains strong. Both the provisional 55-day and 100-day SMAs continue to point northward at 1.0857 and 1.0820, respectively. Spot, in the meantime, maintains its business above the critical 200-day SMA at 1.0847, therefore, keeping the short-term constructive bias well in place. Further advances, in the meantime, are likely, with the YTD peak at 1.1194 (August 23) emerging as the immediate upside barrier. A move beyond this level could lead to an advance towards the 1.1200 milestone, ahead of the 2023 peak of 1.1275 (July 18).

In the event of a pullback, immediate support lies at 1.0881 (weekly low from August 8), followed by the 200-day SMA and the August bottom of 1.0777 (August 1).

REGISTRATION LINK 👇🏻

https://one.exnesstrack.net/boarding/sign-up/a/uq2cbl5o/?campaign=24533