GBP/JPY sticks to gains around 191.00, bulls seem non committed amid Middle East tensions

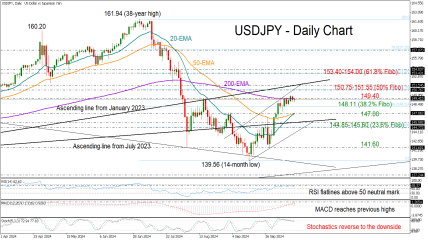

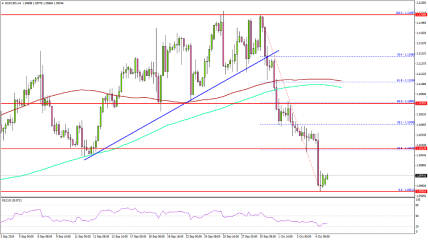

The GBP/JPY cross attracts some dip-buying during the Asian session on Wednesday and reverses a part of the previous day's losses. Spot prices, however, remain below the technically significant 200-day Simple Moving Average (SMA) and currently trade around the 191.00 mark, up less than 0.15% for the day.

The Japanese Yen (JPY) continues to be undermined by the uncertainty over further interest rate hikes by the Bank of Japan (BoJ), which, in turn, is seen as a key factor lending some support to the GBP/JPY cross. In fact, Japan's new Prime Minister Shigeru Ishiba said earlier this week that the BoJ's monetary policy must remain accommodative to underpin a fragile economic recovery. Moreover, Ishiba seeks to secure a national mandate with an October 27 snap election, fueling political uncertainty and exerting additional pressure on the JPY.

That said, fears of a full-out war in the Middle East escalated further after Iran launched over 200 ballistic missiles at Israel on Tuesday. This, in turn, tempers investors' appetite for riskier assets, which is evident from a generally weaker tone across the global equity markets and should help limit deeper losses for the safe-haven JPY. Furthermore, markets are pricing in another BoJ rate hike by the end of this year. This marks a big divergence in comparison to bets for more rate cuts by the Bank of England (BoE) and should cap the GBP/JPY cross.

In the absence of any relevant market-moving economic releases on Wednesday, the aforementioned fundamental backdrop warrants caution before placing fresh bullish bets around the currency pair. Even from a technical perspective, the 50-day SMA crossed below the 200-day SMA last month, forming a 'Death Cross' on the daily chart. Furthermore, the GBP/JPY cross has repeatedly failed to find acceptance above the 200-day SMA. Hence, strong follow-through buying is needed to support prospects for a further appreciating move.

ECONOMIC CALENDAR LINK👇🏻 💥

https://one.exnesstrack.net/calendar/a/qhhnixni2g/?campaign=25700