Gold price remains below all-time peak, traders seem non committed amid pre-Fed lull

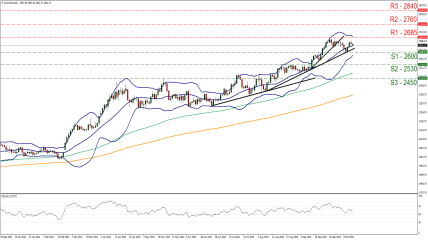

Technical Outlook: Gold price dip-buying should limit any corrective slide to $2,530-2,525 resistance breakpoint

From a technical perspective, bulls might now wait for a move beyond the $2,589-2,590 region, or the all-time peak touched on Monday, before placing fresh bets. The subsequent move up has the potential to lift the Gold price above the $2,600 mark, towards testing the top boundary of a short-term ascending channel extending from sub-$2,400 levels touched late June. The said barrier is currently pegged near the $2,609-2,610 area, which if cleared decisively will confirm a fresh breakout and set the stage for an extension of the recent well-established uptrend.

On the flip side, some follow-through selling below the overnight swing low, around the $2,561-2,560 area, could pave the way for deeper losses towards the $2,530-2,525 strong horizontal resistance breakpoint. Any further decline is more likely to attract fresh buyers and remain limited near the $2,500 psychological mark. The latter should act as a key pivotal point, which if broken decisively could drag the Gold price to the $2,475-2,470 confluence – comprising the 50-day Simple Moving Average and the lower boundary of the aforementioned trend channel.

REGISTRATION LINK 👇🏻

https://one.exnesstrack.net/a/xfbfc8hw70