Gold price remains depressed amid optimism over China stimulus, lacks follow-through

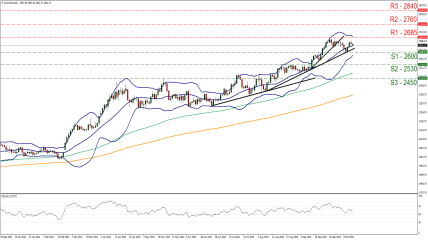

Technical Outlook: Gold price setup remains tilted in favor of bulls, $2,625 resitance-turned-support holds the key

From a technical perspective, any subsequent fall is likely to find decent support near a short-term ascending trend-channel resistance breakpoint, around the $2,625 region. This is followed by the $2,600 mark, which if broken decisively could pave the way for some meaningful downside in the near term. Given that the Relative Strength Index (RSI) on the daily chart is still hovering near the overbought zone, the Gold price might then accelerate the slide towards the $2,560 intermediate support en route to the $2,535-2,530 region.

On the flip side, the $2,670-2,671 area now seems to act as an immediate hurdle ahead of the $2,685-2,686 zone, or the record high touched last Thursday. This is closely followed by the $2,700 round figure, which if conquered will be seen as a fresh trigger for bullish traders and set the stage for an extension of a multi-month-old uptrend.

https://one.exness-track.com/boarding/sign-up/a/uq2cbl5o/?campaign=18842