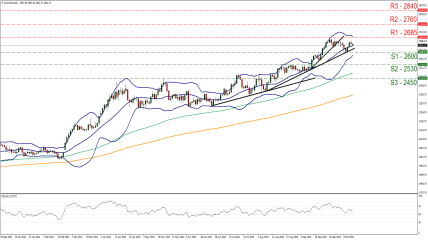

Gold price sticks to modest intraday losses around $2,500 amid positive risk tone

Technical Analysis: Gold price is more likely to attract dip-buyers near $2,470-2,472 resistance-turned-support

From a technical perspective, Friday's breakout through the $2,470-2,472 horizontal barrier and a subsequent strength beyond the previous all-time high was seen as a fresh trigger for bullish traders. Furthermore, oscillators on the daily chart are holding in positive territory and are still away from being in the overbought zone, suggesting that the path of least resistance for the Gold price is to the upside. That said, failure to build on the momentum beyond the $2,500 psychological mark warrants some caution for bulls. Hence, it will be prudent to wait for some follow-through buying beyond Friday's allow-time peak, around the $2,509-2,510 area, before positioning for any further gains.

On the flip side, the $2,472-2,470 resistance breakpoint now seems to protect the immediate downside. Any further decline is more likely to attract fresh buyers and remain limited near the $2,448-2,446 region. The latter should act as a key pivotal point for short-term traders, which if broken decisively should pave the way for deeper losses. The Gold price might then accelerate the corrective slide towards the 50-day Simple Moving Average (SMA), currently pegged near the $2,388-2,387 zone, with some intermediate support near the $2,400 round figure.

REGISTRATION LINK 👇🏻

https://one.exnesstrack.net/boarding/sign-up/a/uq2cbl5o/?campaign=24533