Morning briefing: Euro can head towards 1.1200

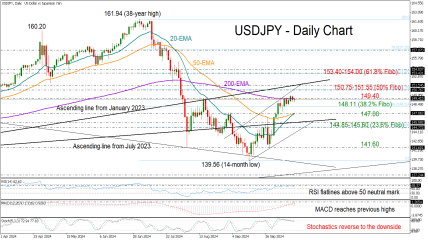

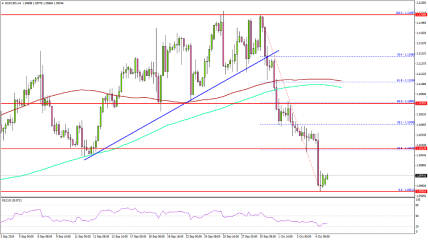

The Dollar Index is attempting to rise back while above 101. Powell's speech at the Jackson Hole scheduled today is awaited. Euro can head towards 1.12/1.13, if it sustains above 1.11. USDJPY and EURJPY need to hold above 145 and 160 to continue the corrective up move. The pound needs to sustain above 1.31 to head towards 1.32, else it can get dragged towards 1.29/28 in the medium term, and Aussie looks bearish to 0.6650 or lower. USDCNY may trade above 7.12 for now. EURINR needs to sustain above 93 to head towards 94 from where a dip can be seen. USD INR may continue to trade within 83.85/90-83.40 for the near term.

The US Treasury yields have bounced back. Key resistances can cap the upside if the yields rise more from here. Broader view is bearish, and the yields can fall back again. The US Fed Chairman Jerome Powell’s speech today at the Jackson Hole meeting will be an important event to watch. Any hint on a rate cut in September can move the market. The German yields have risen back but are likely to be short-lived. The trend is down and there is more room for the yields to fall from here

Dow Jones is holding well below its resistance level and might fall towards 40500-40400. Thereafter we need to see if bounces back from there or breaks lower. DAX and Nifty continues to rise and remain bullish for the near term. Nikkei can rise towards 39000-40000 in the near term while above 37500. Shanghai remains vulnerable for a fall towards 2800.

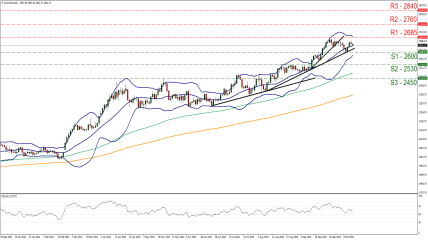

Crude prices have bounced back as the mentioned support held well and looks bullish to target further upside. Gold, Silver and Copper have fallen in line with expectations and may fall further from here. Natural gas has broken below the lower end of the range and has room to come down further in the near term.