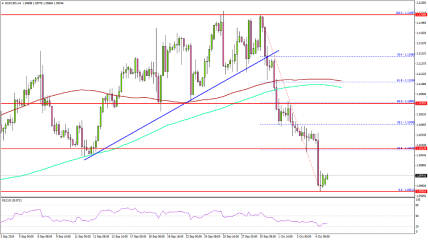

Morning briefing: Euro can trade within 1.1200-1.1100 for now

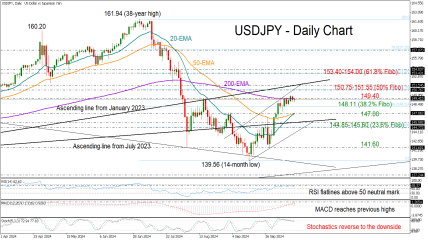

The Dollar Index can remain stable within 101.50-100.20 for now. Watch US ISM Manufacturing data release scheduled today. The Euro, while below 1.12 can trade within 1.12-1.11 for now. USDJPY and EURJPY seem to be rising well but could soon face near term resistance which could limit the upside. The Aussie needs to rise past 0.6950 to become further bullish while the Pound may trade within 1.3440-1.33. USDCNY is trading near the crucial support at 7. EURINR tested 94 on the upside but could not sustain and started coming off. For now, the range of 94-92.50/92 can persist for a while. USDINR has closed just below the crucial level of 83.80. The bias remains ranged between 83.70/80- and 83.40/50 for a while.

The US Treasury yields have inched up. Resistances can cap the upside and keep the broader downtrend intact. We expect the yields to fall further from here. The US ISM PMI data release today is important. A weak PMI number can drag the yield further lower. The German yields remain lower. The view remains bearish. More fall is on the cards. The 10Yr GoI has dipped. We expect it to sustain above the support and rise in the coming days.

Dow Jones has bounced back well while Dax and Nifty have fallen and could test respective supports before resuming to rise again soon. Nikkei has fallen but may remain ranged above support at 37500/37200 while Shanghai continues to shoot up with another gap up opening today, targeting 3400-3410 soon where a pause can be seen.

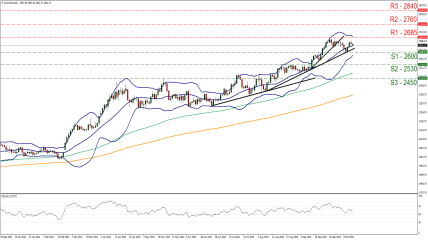

Most commodities look bearish. The rise in the Middle East conflicts which had led to the killing of the Hezbollah and Hamas leaders in Lebanon and the hitting of Houthi targets in Yemen has not received any response from Iran, which backs these three groups. It is yet to impact a supply disruption in Iran but despite the rising conflicts, Brent and WTI have dipped and can remain stable to bearish in the near term. Gold, Silver, and Copper have fallen and could continue to fall in the next few sessions. Natural Gas also looks bearish below crucial resistance near 2.9-3.00.

Recommended Broker