Silver Price Prediction: XAG/USD bulls have the upper hand while above $29.20 confluence

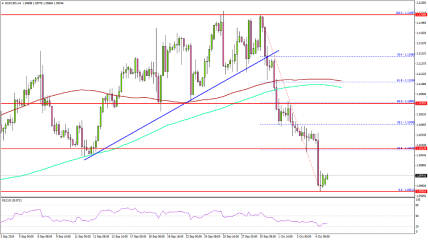

Silver (XAG/USD) attracts some sellers during the Asian session on Thursday and reverses a major part of the previous day's positive move. The white metal, however, manages to hold above the 50-day Simple Moving Average (SMA) and currently trades around mid-$29.00s, down 0.40% for the day.

The 50-day SMA, currently pegged near the $29.20 region, coincides with the 50% Fibonacci retracement level of the July-August decline and should act as a key pivotal point for the XAG/USD. Against the backdrop of Tuesday's failure near the $30.00 psychological mark, a convincing break below the said confluence might prompt some technical selling and pave the way for deeper losses.

The XAG/USD might then weaken further below the $29.00 round figure, towards testing the 38.2% Fibo. level support near the $28.55 region. Some follow-through selling has the potential to drag the white metal towards the $28.00 mark, below which the downward trajectory could extend further towards the $27.25 region en route to the next relevant support near the $27.00 round-figure mark.

That said, oscillators on the daily chart have been gaining positive traction and are far from being in the overbought zone. This supports prospects for the emergence of some dip-buying at lower levels and warrants some caution for bearish traders. That said, it will still be prudent to wait for a sustained strength beyond the $30.00 mark before positioning for any meaningful appreciating move.

The subsequent move-up will set the stage for a move towards the $30.55-$30.60 area, or the 78.6% Fibo. level, above which the XAG/USD could aim to reclaim the $31.00 mark. The XAG/USD might then accelerate the momentum further towards the $31.30-$31.40 supply zone en route to the July swing high, around the $31.75 region, the $32.00 level and the $32.50 area, or the YTD peak touched in May.