25 Sep 2024

USD/INR drifts lower on improved risk appetite, softer US Dollar

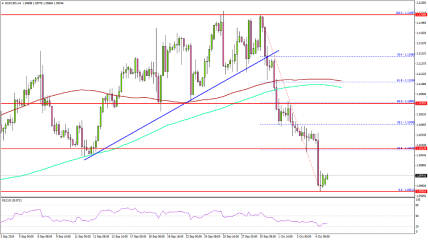

Technical Analysis: USD/INR’s negative view remains unchanged in the longer term

The Indian Rupee trades on a stronger note on the day. The negative outlook of the USD/INR pair prevails as the price remains capped under the key 100-day Exponential Moving Average (EMA) on the daily chart. The downward momentum is supported by the 14-day Relative Strength Index (RSI), which stands below the midline near 36.00.

The first downside target for the pair emerges at 83.44, the low of September 23. A breach of this level will see a drop to the crucial support level at 83.00, representing the psychological level and the low of May 24.

Sustained trading above the 100-day EMA at 83.62 could pave the way to the support-turned-resistance level at 83.75. The key barrier for USD/INR is located at the 84.00 round mark

ECONOMIC CALENDAR LINK👇🏻 💥

https://one.exnesstrack.net/calendar/a/qhhnixni2g/?campaign=25700