23 Aug 2024

USD/INR loses momentum, investors await Fed Chair Powell’s speech

Technical Analysis: USD/INR’s constructive outlook remains in place

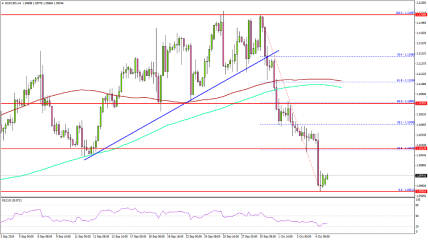

Indian Rupee trades firmer on the day. The most notable feature of the USD/INR pair is the strong uptrend as the price remains above the key 100-day Exponential Moving Average (EMA) and the 11-week-old uptrend line. Additionally, the 14-day Relative Strength Index (RSI) points higher above the midline near 58.40, suggesting that the bullish momentum is sustained.

If USD/INR pops up bullish pressure above the 84.00 psychological mark, the pair could retest the record high of 84.24. A decisive break above this level may attract buyers to 84.50.

Sustained trading below the ascending trendline around 83.92 could draw in sellers and drag the pair to 83.77, the low of August 20. The next contention level to watch is the 100-day EMA at 83.57.